Investing today is not child’s play.

With all the financial instruments available, it is not easy to choose the one that is right for us. Much depends on our predisposition to risk, the capital we want to invest, and the duration of the investment itself. Those are all fundamental aspects to evaluate a good financial instrument.

What are Tax Liens exactly?

Maybe some of you already know what Tax Liens are, but you probably don’t know their origins and why they were created, so let’s introduce my favorite investment.

Tax Liens were created over 300 years ago by the county to “incentivize” the recovery of unpaid real estate taxes.

They are typically the only revenue source a county receives to provide essential community services such as public safety, school education, garbage collection, and maintenance of public infrastructures such as roads and bridges, etc. All comes from property taxes. So know you understand if the residents of that county don’t pay their taxes by the due date, the county might face big financial problems.

How do Tax Liens work?

The way it works is as simple as it is ingenious: if a property owner fails to pay taxes for more than a year, the county places a lien, called a Tax Lien, on the delinquent property until he or she pays off the back taxes plus the applicable penalty or interest rate. The penalty is calculated on the amount of taxes owed and can go up to 36% per year.

The county in order to recover those back taxes in the least amount of time, issues a Tax Lien Certificate and puts it up for sale at a public auction, once or more times a year.

At the auction, ANYONE can buy that Tax lien and take advantage of the interest rate set by the county.

But Tax Liens are also very interesting for another reason. You should know that if you buy a tax lien, your investment is guaranteed by the property on which the tax lien is placed. This means that if the property owner does not pay the taxes plus interest within a certain period of time (called redemption period), he or she will risk losing the house! The investor holding the tax lien, once the redemption period has expired, can apply to the county to start the foreclosure process. Once this procedure is completed, the property will be automatically transferred to the investor who holds the tax lien certificate free and clear. Caution! Some debt might survive the foreclosure auction, so you have to do your research carefully!

Getting a property through a tax lien is very rare, If you’ve done your research right and you bought the certificate on a good valued property, you have a 5% chance.

But is it a safe investment?

Many of my students often ask me, how is such a thing possible? The explanation is quite simple. Tax Lien Certificates have a first position lien priority over any other lien holder. This means that if the property is backed by a mortgage, your Tax Lien will “override” the bank.

In that case, either the bank will pay the Tax Lien instead of the owner, or both (Bank and owner) will lose the property.

I know that for many this system may seem drastic or too “hard” in some ways. But history shows that if institutions are too “soft” many citizens take advantage of it to the detriment of those who pay regularly and behave honestly and respectfully towards others and respect the law.

The system is designed to give the delinquent property owner “urgency” in paying their property taxes within the time limits established by law, while still giving him time to come up with the tax money owed. On the other hand, the county will recover the tax money needed to ensure all the essential services to the community without penalizing citizens who have regularly paid their taxes on time. The investor obtains a secure return on the money invested with an underlying guarantee many times greater than the investment made.

A true win-win-win situation.

What is the definition of Tax Lien?

A Tax Lien is a first position lien and legal claim issued by the county government, against the assets of an individual or business that fails to pay taxes owed to the government.

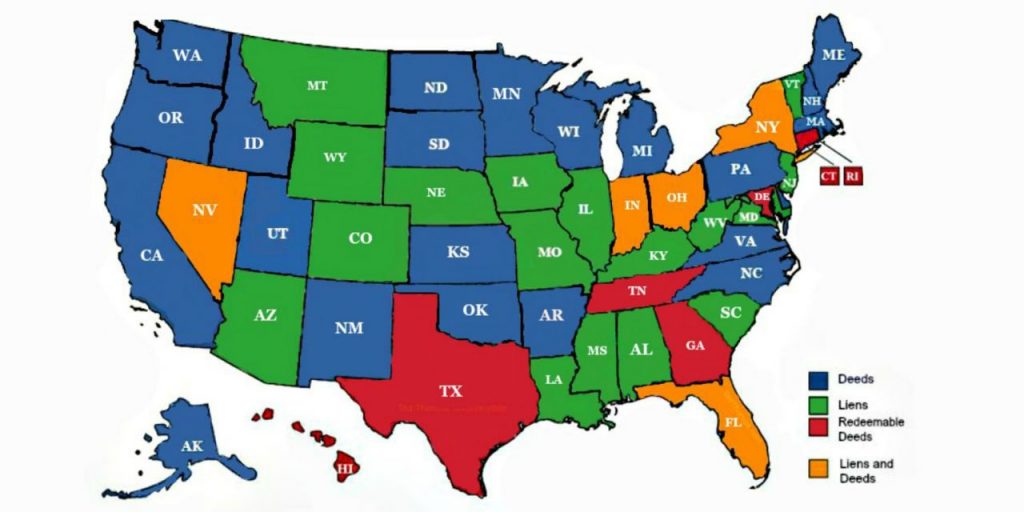

Do all U.S. states offer Tax Lien?

Not all states offer Tax Liens, only about half of them do, but we’re still talking over 1,500 counties, so there are plenty of Tax Lien to buy! The other half of the states rely on Tax deeds to catch up on the back taxes.

Both of these types of investments are very lucrative for the investor, and allow the county to recover back taxes and be able to continue to provide essential services to the community.

So, with Tax Liens and Tax Deeds, we are helping the county and the community in providing efficient and essential services. We’re also helping the owner have more time to pay the back taxes. The county in return rewards us with a very attractive fixed interest rate on the money we invest. In addition, as collateral for our investment, we have a first position lien on the underlying property.

How are Tax Liens sold?

The county sell-off all Tax Lien Certificates through an auction which can be live or online. More and more counties are relying on specialized companies to organize online auctions on behalf of the county. By registering with these sites, you will have the opportunity to participate in these auctions and purchase tax liens or tax deeds.

I would be very pleased to read your comments or answer your questions.

See you soon,

Emanuel Wijkhuisen