Earning money online is easy and fun with Tax Liens (if you still don’t know what Tax Liens are read this article). In this article, I’ll show you how I bought a Tax Lien property in Florida that allowed me to gain a 5% interest on my money in just over 1 month.

How do online auctions work in Florida?

Most investors who purchase Tax Liens in Florida do so through auctions that are organized by county tax collectors. Online auctions in Florida are held in May each year. Competition is fierce and often the interest rates, which start at 18%, are bid down to a few percentage points.

As a savvy investor, I usually prefer to wait until the end of the auction and purchase the unsold tax liens directly from the county. This allows me to avoid competition typical of online auctions and get the maximum interest rate offered by the State.

By Florida statutes, the maximum interest rate you can earn on a tax lien certificate is 18% per year or 1.5% per month. For example, if I buy a tax lien in April and the owner redeems the certificate in May, the county should theoretically pay me back the money invested plus 1.5% interest, as only one month of interest will be paid, right?

Wrong!

Per Florida statutes, if the owner redeems your tax lien certificate before 3 months’ time, the county will pay us a nice 5% interest on our tax lien certificate.

This also applies if you buy a tax lien at auction at the minimum interest rate, which in Florida is 0.25%. This is exactly why the big investment banks, buy several million dollars in Tax Liens every year at auctions. Usually, those big investors bring the interest rate close to zero to beat the competition and still receive a nice 5% return on millions of dollars invested.

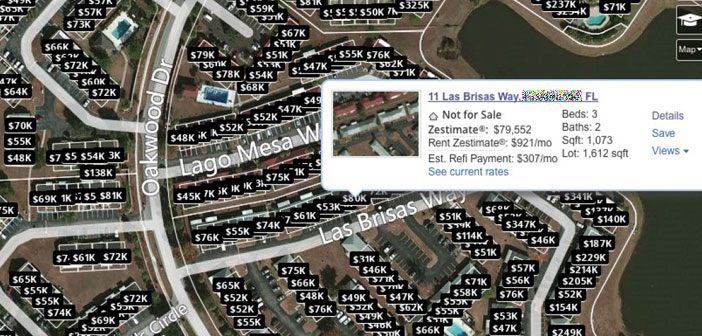

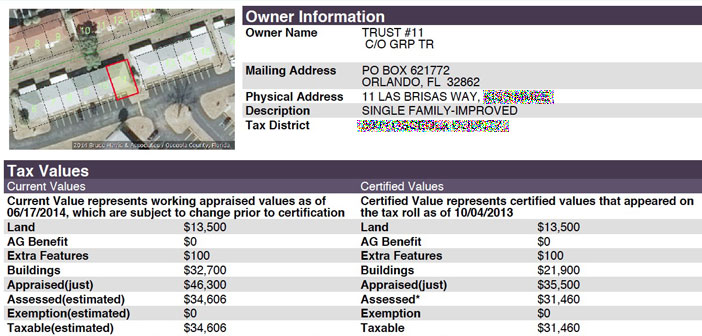

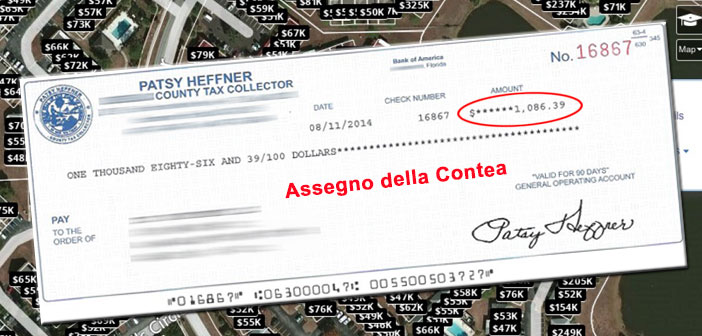

In the photos above you can see pictures of the property, its presumed market value and the check that came to us from the county.

Let’s look together at some data on the Tax Lien Certificate I’ve purchased.

I purchased this tax lien for $1,034.66 directly from a Florida county, this locked me at an interest rate of 18% per annum or 1.5% per month.

A little over a month later, I received notice, along with the check, that the owner had paid off his outstanding property taxes to the county. My tax lien certificate was paid off with the payment of the amount owed, plus accrued interest. total check received $1,086.39, That’s a nice 5% interest in just a month!

I know, for many people $51.73 may seem like a ridiculous amount of money, but I consider it a major accomplishment. Consider that I earned this amount automatically by investing in research no more than 10 minutes of my time using FastLien. I invested a small amount of money and I made a great return. Also, consider that hardly any bank will be able to give you the same kind of interest on a monthly basis with the same underlying security.

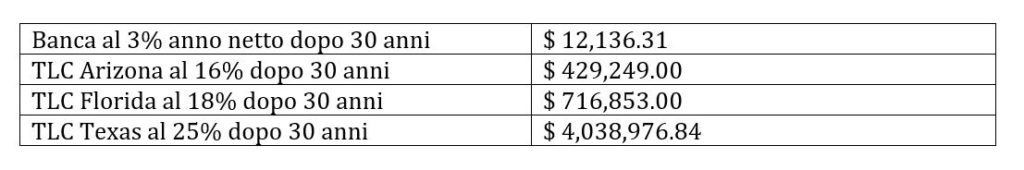

What happens if we apply the same result over longer time frames and slightly larger amounts?

To get a better understanding. I want to show you what happens by comparing the same performance achieved with the tax lien certificate we saw above. For fun, let’s increase the time and amount invested and compare it to any bank deposit account.

Let’s invest $5,000 and continue to invest this money following the compound rate rule (continually reinvesting profits) for a period of 30 years. In the case of tax liens, this means that whenever a tax lien is paid back, you will immediately need to invest the earned amount in another tax lien at the same interest rate. In the sheet below you can see the various types of instruments compared. (TLC = Tax Lien Certificate)

In the example above we have not taken into account that some tax liens certificates will not be paid off and we may find ourselves owning the property that we can potentially rent or resell for an even greater return on our money.

Some of you will say that we have not taken into account taxes to be paid on the profits generated. This is true, but there are several ways to avoid taxation, for example using a self directed Roth IRA or even using a QRP. This is a self-administered, tax-deferred trust with which you can purchase any asset deferring tax payment on profits generated. We will talk more in depth about QRP’s in another article.

It is not difficult to understand that there is no comparison with a traditional deposit account or any other investment vehicle. If you are CONSISTENT investing in tax lien certificates can really be a great way to earn money online and provide you with a great passive income, and who knows even achieve financial freedom.

Greetings from Emanuel.