In this article I would like to share a successful recent operation we made, the profit and all details.

Ready? Let’s start

Let’s imagine the story of a tax lien in Lee County (Florida).

One day the owner of a beautiful property, for several reasons, is unable to pay the property tax (in Italy would be our IMU).

What happens in this case?

– The owner finds himself with a lien on his property for not paying the taxes and risks losing the house in a foreclosure.

– The county will have no revenue and will not be able to pay for the services it provides in its territory.

In short, a big problem.

This is where the tax lien and its potential come in.

On the unpaid taxes, the county will issue a certificate (with interest and the property as collateral) and auction it off.

The maximum interest rate, in Florida, will be 18% per year (1.5% per month), and at the auction there may be bids at a lower rate (e.g., 17.5%, 16%, etc.). Whoever bids at the lowest rate will get the tax lien certificate, with an expiration date (in Florida the tax lien expires two years from the year the taxes were not paid, after which the property is foreclosed).

This will accomplish two key things:

– The owner can be helped because he will have more time (2 years) to pay off the taxes, and he may have to avoid paying the maximum penalty because the certificate could be auctioned off at a lower rate of 18%.

– The county will immediately have the funds in its treasury to pay for the services it provides: road maintenance, schools, salaries, etc.

However, it can happen that many tax lien certificates are not awarded at auction. One reason for this may be that there is an oversupply of certificates compared to the buyers attending.

This situation can lead to a difficulty: the county will only have a portion of the funds available in the immediate term.

In this case, the tax lien becomes an OTC.

OTCs are all the unsold tax liens during the auction that are placed by the county on a special list. The investor only has to study the list, find the most interesting certificate for him, contact the county and buy it. In this process, the interest rate will be the maximum one: 18%, because there will be no bids, but there will be a process where the first one who contacts the county and buys the tax lien wins.

This process resolves several problems: the county will have the funds and the owner will still have time to pay off his debt.

Well, this is also the same story with the tax lien I am about to present to you.

The owner of a property in Lee County could not pay the property tax and so the county issued a certificate to auction it off.

No one bid on this certificate, so after the auction it ended up on the OTC list.

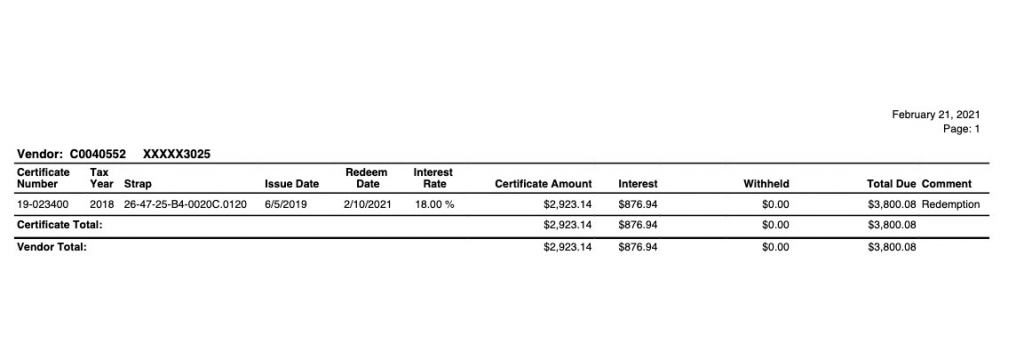

Our partner Emanuel Wijkhuisen scanned the list with FastLien, like a prospector searching the river for a gold nugget, spotted this certificate, and immediately called the county to buy it. The amount to purchase it was $2,923.14.

Being OTC, Emanuel was awarded the certificate with the top rate of 18%.

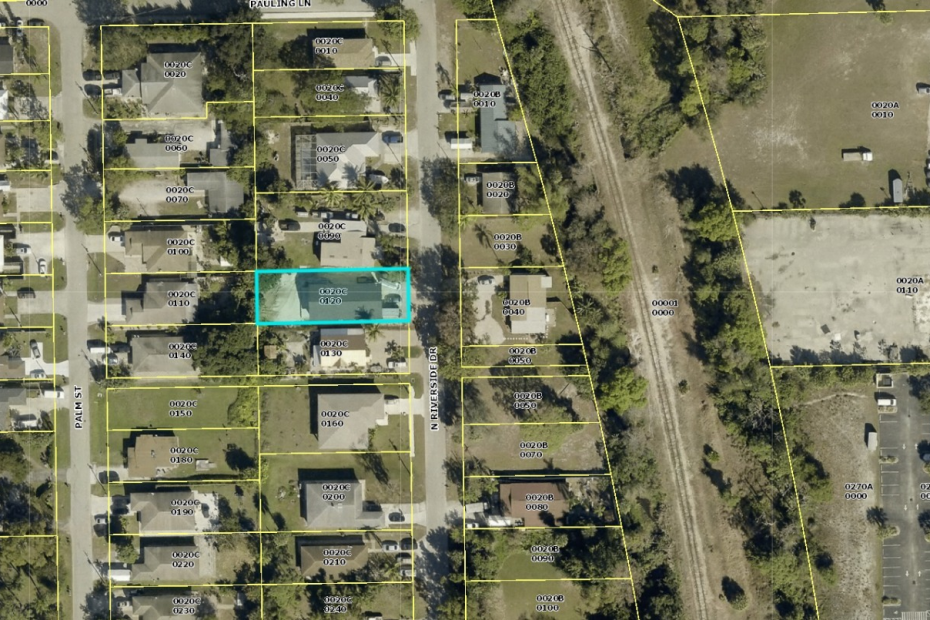

The property (Address: 26800 N RIVERSIDE DR BONITA SPRINGS FL 34135) that the certificate was issued on was a single-family home with 3 bedrooms and a bathroom, for about 170sqft. The market value was $254,746.

How did it turn out?

Recently, Emanuel received a nice check from the county, for $3,800.08. The owner recovered financially and was able to meet his obligations by refunding the unpaid taxes plus accrued interest.

Summary:

| Interest: | 18% yearly (1,5% per month) |

| Purchase date | 06/05/2019 |

| Price | 2,923.14 $ |

| Paid on | 02/10/2021 |

| Collected amount | 3,800.08 $ |

| Earnings | 876.94 $ |

| ROI | 30% |

| Time | 20 months |

Fantastic investment!!! In a particularly turbulent period moreover (presidential elections, covid and economic crisis).

Just think: with an investment of $ 2,923.14 you will have an excellent return and real estate collateral with a value exceeding $ 254,000, I would say that as a margin of safety is unique.

What if the owner hadn’t paid in the two years? Well, two scenarios would have presented themselves:

– The property would have gone to auction, and whoever won it would have first had to repay the principal that Emanuel had allocated, plus interest.

– If no one had won the property at auction, Emanuel would have had title to the property on which the tax lien had been issued, and would now own a single-family home worth $254,746 for the cost of $2,923.14, a yield of 8,614%. Not bad investing in the brick!!!

Statistically, the odds of doing the foreclosure and getting the property are very low, over 90% of the tax lien is repaid by the owners.

If you happen to foreclose on an unpaid tax lien you will have hit the jackpot. Obviously, you will need to do the proper due diligence to find a tax lien with good real estate collateral. There are no profit opportunities without risk, but with study and perseverance as true financial creatives, you can get great results even in times of crisis.

In short, a magnificent investment for our Emanuel, who not only obtained an excellent return but also slept soundly in these months, knowing that his capital was guaranteed by such an important property.

So, did you like this case study? Ready to scour the tax lien lists to find your golden nugget too?

Start NOW your research with FastLien 7 days Trial for FREE

Good investments and see you next time